Get a No-Obligation Cash Offer on Your Orlando House

Skip the hassle, agents, and fees. Get a fair offer within 24 hours from your trusted local homebuyer.

Get A Cash

Offer Today!

Enter your property details below. if you’d rather, you can give us a call and we can go over this info over the phone at 407-214-7422. Whichever is easiest for you!

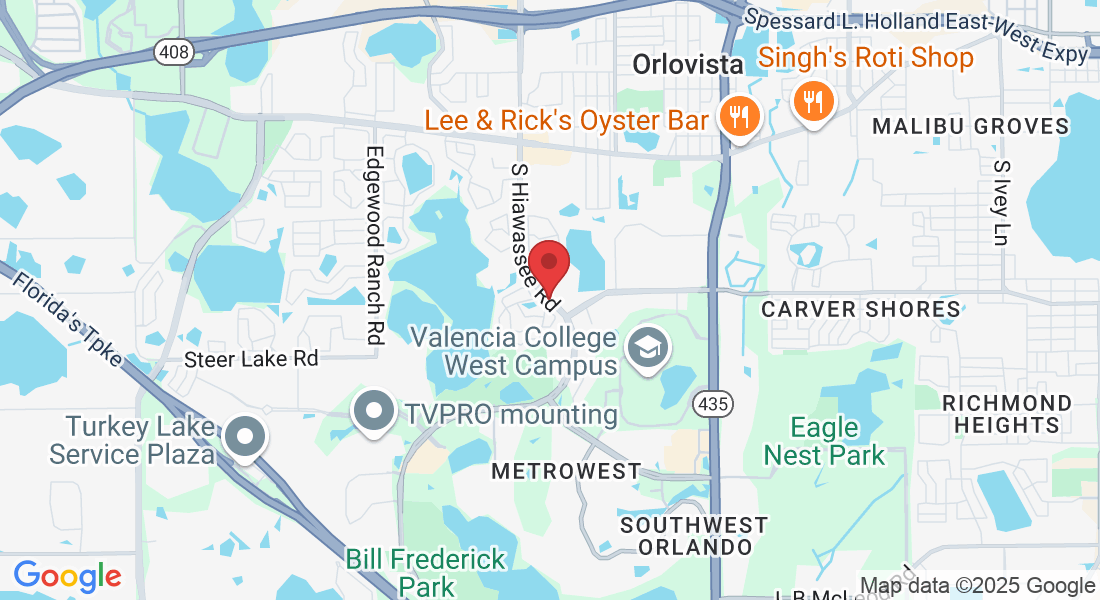

Contact

Mailing Address

1072 S. Hiawassee Road Orlando FL 32835

Office Hours

Monday - Friday: 9:00 AM -5:00 PM

Saturday & Sunday: Closed

Socials

We Buy Houses for Cash

Skip the wait. Get a fair cash offer in as little as 24 hours.

Sell As-Is, No Repairs Needed

No cleaning, no fixing — we’ll take it just how it is.

No Fees, No Commissions

No agents. No hidden costs. What we offer is what you keep.

Close on Your Timeline

You pick the date. We’ll work around your schedule.

We buy houses Fast and Pay Cash!

Ashley T.

Reid Real made selling my home so easy! They gave me a fair cash offer, handled everything quickly, and I didn’t have to make any repairs. Highly recommend them if you need a fast, stress-free sale!

Jessica R.

I had an awesome experience with Reid Real! They were super easy to work with and closed exactly when I needed. Definitely recommend!

Daniel M

Huge thanks to Reid Real for making the selling process so smooth! They were professional, fast, and made a great offer. I couldn’t be happier!

General Questions

Frequently Asked Questions

Explore our most frequently asked questions to learn more about how we can help you succeed.

Got a more specific question? Don’t hesitate to reach out—we’d love to help!

What does “as-is” mean?

Selling “as-is” means you don’t have to fix a thing. We’ll buy your house in its current condition—no repairs, no cleaning, no stress.

What does an “all-cash offer” mean?

It means we use our own funds—no banks, no delays. When we say cash offer, we mean real money in your hands, fast.

How fast is a fast closing?

We can close in as little as 7 days—sometimes even faster, depending on title and paperwork. You choose the date that works for you.

What if I don’t need a fast closing?

No problem! We work on your timeline. Need a few weeks or a couple of months? We’ll wait until you’re ready.

Will I get a lowball offer?

Absolutely not. We evaluate your home’s condition, local comps, and your unique situation to make a fair, no-pressure offer.

Is this even legit?

Yes, 100%. We’re a local real estate investing company with real reviews and real results. No tricks, no fees—just honest help for homeowners.

Get In Touch

Email: [email protected]

Address

1072 S. Hiawassee Road

Orlando FL 32835

Assistance Hours

Mon – Friday 9:00am – 5:00pm

Saturday & Sunday – CLOSED

Phone Number:

READY TO SELL YOUR HOUSE?

Take the First Step Toward a Fast, Stress-Free Sale

We're here to make selling your house simple, quick, and hassle-free. Reach out to Reid Real today for a fair, no-obligation cash offer. Let’s help you move forward with confidence!

We buy houses Fast and Pay Cash!

Any Condition and Creative Financing Strategies for Those Behind on Payments

© 2025 Reid Real Investments LLC | All Rights Reserved. | Powered by Mighty Automation.